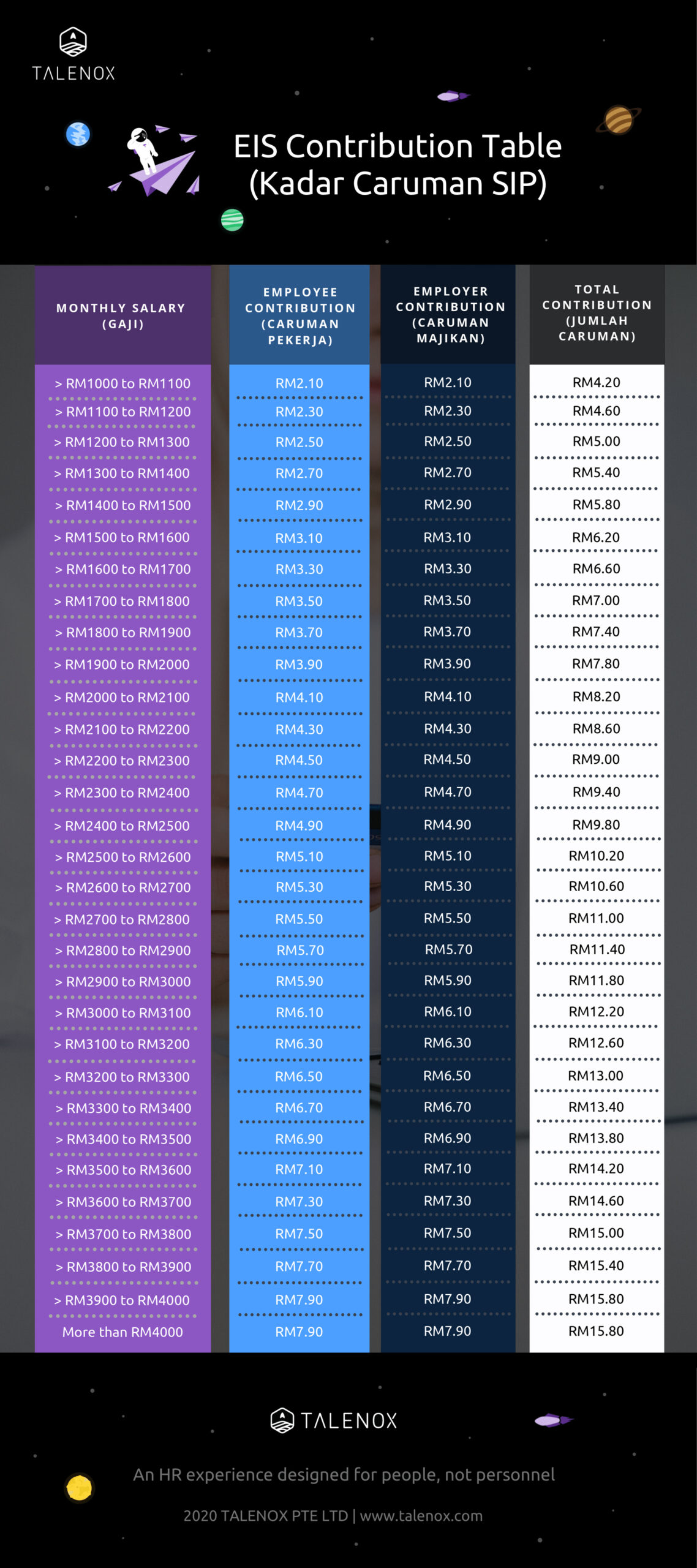

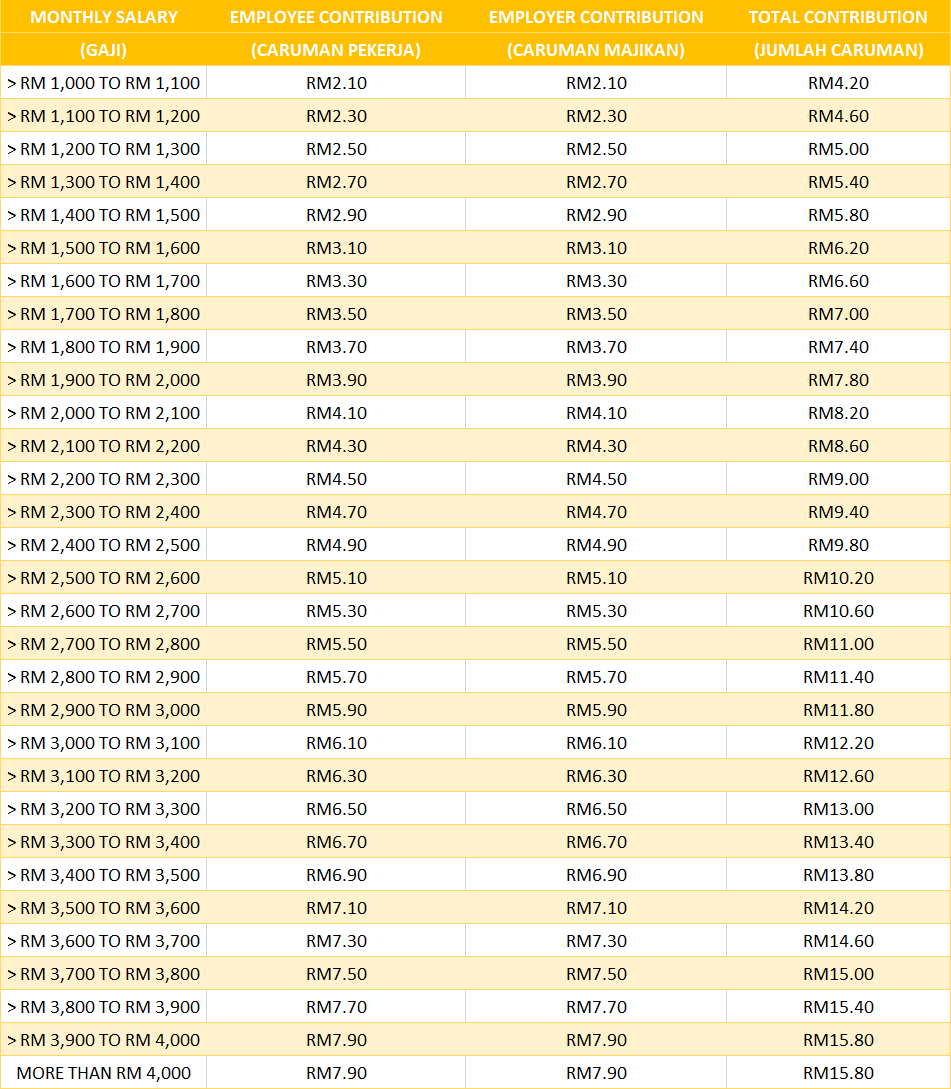

When wages exceed RM50 but not exceed RM70. The Contribution rate is based on Section 18 and Schedule 2 of the Employment Insurance System Act 2017.

New Minimum Wage And Socso Requirements Donovan Ho

For each employee an employer has to pay National Insurance on all earnings above 73200 per month.

. Age 18 to 60. The rate of National Insurance is 138. EIS is a powerful technique.

To assess adverse effects from a vaccine or pharmaceutical consider using total doses distributed as the denominator. Please do not simply calculate 02 x. If you are a National Education Union member the majority of your work is classroom based but some of your work is as a musician performing writing or teaching you can join the Musicians Union at half the annual subscription rate.

You can view them with our interactive web map and in an appendix to the Final EIS. F is the Fermi constant Eis the neutrino energy. Remember that the premium should be calculated based on the premium rate specified in the second annex of the Employment Insurance System Act 2017 and not on the exact calculation of interest.

PERKESO ASSIST portal. There are a few channels EIS have disclosed on where employers may auto deduct from. Coverage of the.

Wages up to RM30. All employers in the private sector whose employees are covered under the Act are. For eligible new employees who are 55 years of age they must be covered under the Second Category.

This calculation only applicable to Loss of Employment LOE happened before 1st January 2021For LOE starting from 1st January 2021 until 30th June 2022 click HERE to calculate your benefit. The Preferred Alternative refines the draft proposal we published in October 2016. The sweat rate and electrolyte concentration total ionic charge concentration can be decoupled from the interval time and the peak value of the square-wave curve respectively.

However in certain BSM scenarios the ES contribution could increase signi cantly making it important to include it since stronger constraints can be obtained. The EIS contribution is deducted the same way as SOCSO which is on the15th of each month. When wages exceed RM70 but not exceed RM100.

The sensor detection range is 0520 μL min 1 cm 2 for sweat rate and 1200 mM for total electrolyte concentration which covers the typical exercise-induced sweat range. In November 2017 we published our Preferred Alternative maps for MHA implementation. ES is a concurrent process to CE NS.

The minimum eligible monthly salary can be as low as RM30 the contribution is RM010 monthly. For example a maternal mortality ratio and infant mortality rate use births in a calendar year as a denominator for deaths in the same calendar year yet the deaths might be related to births in the previous calendar year. Members of each union can join the other at a reduced rate.

In the SM its contribution to the total event rate at low recoil energies is very small and thus it is usually neglected in CE NS analyses. An employee has to pay National Insurance contributions if they earn more than 792 per month 416700 79201 337499 x 12 40499. 02 The contribution rates stated in this table are not applicable to new employees who are 57 years old and above who have no prior contribution.

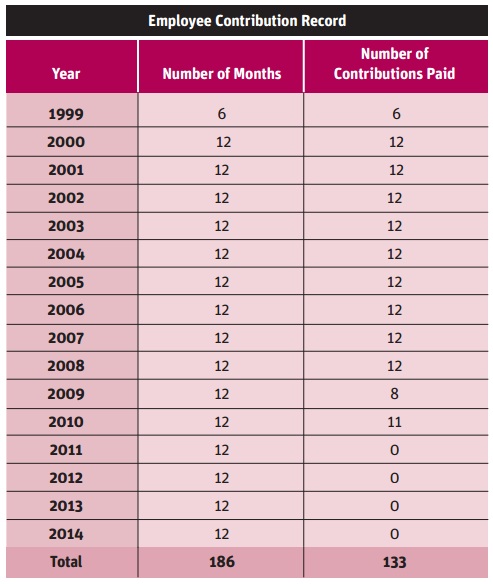

When wages exceed RM30 but not exceed RM50. Therefore the amount reflected on your payslip will not be exactly 02 percent of your salarywages gaji. Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC ie.

Another example is injuries from snowmobile use. The EIS contribution rate table is as below. The number of monthly contributions you have paid.

The rate of contribution under this category is 125 of employees monthly wages payable by the employer based on the contribution schedule. In addition the length of the. Employees status Employers and employees EIS contribution rate Age 18 to 60 02 How can employers make their EIS contribution payments.

The 2021 edition of the innovation scoreboard shows that Europes innovation performance continues to improve across the EU. Employers and employees contribution rate for EIS. This years EIS report is also accompanied by the 2021 edition of the regional innovation scoreboard which provides comparable results for 240 regions in 22 EU countries.

We took feedback on this draft through June 2017 and incorporated your input into the Preferred Alternative. The actual contribution amount follows Section 18 Second Schedule of the Employment Insurance Act 2017 not the exact 02 percent calculation. Looking at the table above why is my EIS contribution not exactly 02 of my wagessalary gaji.

Please bear in mind that the contribution amount should be calculated based on the contribution rate. Electrochemical impedance spectroscopy EIS is used to study a wide variety of systems in many fields of electrochemistry such as electrode kinetics double-layer studies batteries corrosion solid-state electrochemistry. On the other hand the maximum eligible monthly salary.

BENEFIT CALCULATOR SIP Note. The contribution rate for Employment Insurance System EIS is 02 for the employer and 02 for employee based on the employees monthly salary. On average innovation performance has increased by 125.

Employers and employees will contribute 02 each of an employees salary this means that the total contribution would be 04 of an employees monthly salary. European innovation scoreboard 2021. Employers and employees EIS contribution rate.

When wages exceed RM100. The EIS contribution rate is shown in this EIS Table does not apply to new employees aged 57 and over who have not previously made a contribution. All employees who have reached the age of 60 must be covered under this category for the Employment Injury Scheme only.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Rate Of Contributions Pdf 5 2 2019 Rate Of Contributions 5 2 2019 Rate Of Contribution Rate Of Contributions No Actual Monthly Wage Of The Course Hero

Malaysia S New Insurance System Automatically Asklegal My

Socso New Avanzo Management Consulting Services 優卓會計 Facebook

Social Security Protection Scheme

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Eis Contribution Rate Pdf Eis Contribution Rate The Contribution Rate For Employment Insurance System Eis Is 0 2 For The Employer And 0 2 For Course Hero

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Socso New Avanzo Management Consulting Services 優卓會計 Facebook

![]()

New Update In Socso Table 2020 For Payroll System Malaysia

Eis Perkeso Malaysia How To Calculate The Eis Contribution Part 2 The Vox Of Talenox

Socso Rate Of Contributions Pdf 9 25 2018 Rate Of Contributions Rate Of Contribution Rate Of Contributions No 1 Actual Monthly Wage Of The Course Hero

Eis Perkeso Eis Contribution Table Eis Table 2021

5 Things About Socso Perkeso You Should Know

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Steps To Apply Employee S Epf Contribution Rate At 11

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php